The North American Deep Value Week – 2026/06

Reports, a Special Dividend & an AGM

Companies mentioned:

· Key Tronic Corporation – Q2 FY2026 results impacted by restructuring and weaker demand

· Tandy Leather Factory – Board declares $0.75 per share special dividend

· Unifi – Q2 FY2026 shows improved gross profit and cash flow after cost and footprint actions

· Beazer Homes USA – Shareholders approve charter amendment extension to protect NOLs and energy tax credits

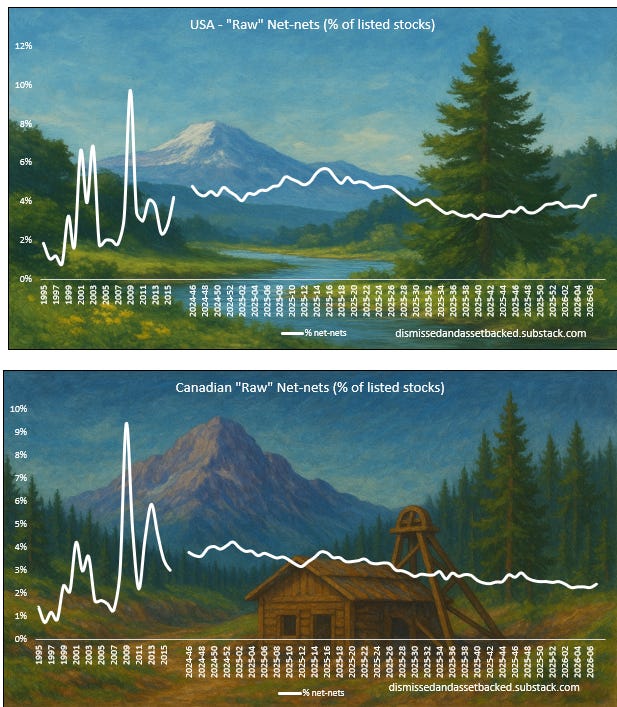

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable.

Key Tronic Corporation – Q2 FY2026 results impacted by restructuring and weaker demand

2026-02-03 │ P/TB 0.32 │ URL

February 3, 2026 – Key Tronic Corporation reported second-quarter fiscal 2026 revenue of $96.3m, down from $113.9m a year earlier, driven by lower demand from a major customer, end-of-life program transitions and delays in new program launches amid macroeconomic and trade uncertainty, partly offset by ramps at other customers and continued expansion of a consigned materials program. The company recorded significant restructuring actions, including the wind-down of manufacturing in China and further workforce reductions in Mexico, resulting in $10.5m of charges but expected combined quarterly cost savings of roughly $2.7m once fully implemented, while production is increasingly shifted toward the US and Vietnam. Gross margin fell to 0.6% and operating margin to -10.7% due to restructuring impacts, although adjusted gross margin improved to 7.9% year-on-year. Net loss widened to $8.6m, but operating cash flow strengthened to $6.3m, enabling a $13.4m year-on-year reduction in debt. Management highlighted new program wins and expects revenue to gradually rebound with a return to profitability by the end of fiscal 2026; however, due to ongoing uncertainty around program ramp timing, Key Tronic Corporation did not provide revenue or earnings guidance for Q3 FY2026.

Tandy Leather Factory – Board declares $0.75 per share special dividend

2026-02-03 │ P/TB 0.48 │ URL

February 3, 2026 – Tandy Leather Factory, Inc. announced that its Board of Directors has declared a special cash dividend of $0.75 per common share, payable on or about February 24, 2026, to shareholders of record as of February 9. Management noted that the dividend follows a $1.50 per share special dividend paid in February 2025 after the sale of the company’s Fort Worth headquarters, and comes after the completion of its move to a new office and distribution center and the opening of a relocated Fort Worth flagship store in December. The company stated it will discuss its fourth-quarter and full-year results with investors in late February, but did not provide any financial outlook or guidance in the announcement.

Unifi – Q2 FY2026 shows improved gross profit and cash flow after cost and footprint actions

2026-02-03 │ P/TB 0.31 │ URL

February 3, 2026 – Unifi, Inc. reported fiscal Q2 (ended December 28, 2025) net sales of $121.4m, down 12.6% YoY, citing trade and tariff-related uncertainty and demand volatility across segments, while cost and footprint reductions helped lift gross profit to $3.6m (3.0% margin) from $0.5m (0.4%) a year ago and reduced SG&A by 25% to $9.7m. Net loss narrowed to $9.7m ($0.53/share) from $11.4m, including $0.8m of net restructuring costs, with adjusted EBITDA improving to -$0.7m from -$5.8m. Operating cash flow was $25.3m in the quarter and $16.4m for the first six months, supported by working-capital improvements, enabling lower leverage (net debt $75.2m vs $85.3m at June 29, 2025). Management said multi-year cost realignment has lowered the revenue breakeven point and positioned the company to generate profits on a meaningfully lower revenue base. In the outlook commentary, management noted early signs of a more normalized operating environment and improving customer engagement, while cautioning that working capital may rise modestly as customers rebuild inventories in calendar 2026 and that Q3 operating cash flow is expected to be lower than in Q2 as a result.

Beazer Homes USA – Shareholders approve charter amendment extension to protect NOLs and energy tax credits

2026-02-05 │ P/TB 0.62 │ URL

February 5, 2026 – Beazer Homes USA, Inc. reported that shareholders at its 2026 Annual Meeting approved an amendment to the company’s charter to extend protective provisions intended to preserve the value of its deferred tax assets, including net operating losses (NOLs) and Energy-Efficiency Tax Credits, by limiting transfers of stock that could result in a holder being treated as owning 4.95% or more of the shares. The company filed the Certificate of Amendment with the Delaware Secretary of State on February 5, and the extension becomes effective February 6, 2026, with the updated “Expiration Date” set to the earliest of several triggers including November 12, 2028. Shareholders also elected directors, approved the advisory vote on executive compensation, and ratified Deloitte & Touche LLP as auditor for FY2026, while additionally approving both the charter amendment and ratification of the associated rights agreement supporting the tax-asset protection framework. No business outlook or financial guidance was included in the filing.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.