The Deep Value Week – 2026/04

Calm Week

Companies mentioned:

· Manitowoc – Board expanded with two new independent directors

· Hooker Furnishings – Sidoti conference takeaways: cost cuts and Margaritaville launch underpin F2027 recovery; PT $15 maintained

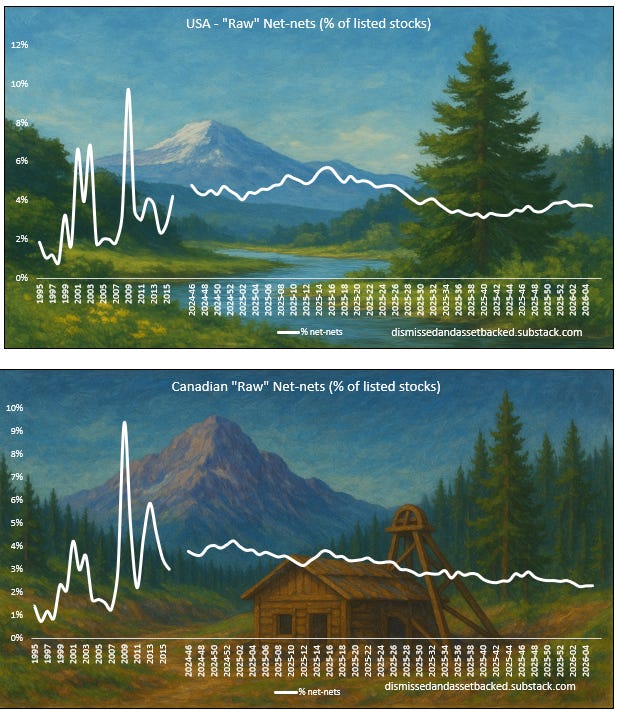

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable.

Manitowoc – Board expanded with two new independent directors

2026-01-21 │ P/TB 1.00 │ URL

January 21, 2026 – The Manitowoc Company, Inc. filed a Form 8-K announcing that it has expanded its Board of Directors from eight to ten members and appointed Mark B. Rourke and Randy A. Wood as new directors, effective immediately, with terms running until the 2026 annual shareholders’ meeting. Both appointees will receive standard non-employee director compensation. Rourke is President and CEO of Schneider National, bringing extensive experience in transportation, logistics, and public company leadership, while Wood is President and CEO of Lindsay Corporation, with a background in industrial manufacturing, irrigation solutions, and international operations. The board chairman highlighted that the appointments strengthen Manitowoc’s operational expertise and governance as the company pursues its long-term growth objectives.

Hooker Furnishings – Sidoti conference takeaways: cost cuts and Margaritaville launch underpin F2027 recovery; PT $15 maintained

2026-01-23 │ P/TB 0.91 │ URL

January 23, 2026 – Sidoti & Company published a morning meeting note on Hooker Furnishings (HOFT) following management’s one-on-one meetings at the Sidoti January 2026 investor conference, arguing the company is positioned for an earnings recovery despite a still “choppy” demand backdrop for home furnishings tied to weak housing activity. The note highlights that HOFT should benefit from price increases, a planned launch of Margaritaville-licensed products (described as ~250 SKUs and largely incremental), and higher Domestic Upholstery sales supported by the current tariff environment, while the company reshapes its portfolio toward higher-margin Hooker Branded and Domestic Upholstery and exits most of the unprofitable Home Meridian business (excluding Samuel Lawrence Hospitality). Sidoti estimates management has removed roughly $25–26m of annualized operating costs, which it expects to be most visible in F2027–F2028, and forecasts EPS of -$0.34 in F2026, $0.88 in F2027, and $1.33 in F2028 alongside a return to revenue growth in F2027. Sidoti maintains a $15 price target, based on 11x its F2028 EPS estimate, and reiterates a moderate risk rating, citing expected profitability recovery, a solid balance sheet, and supportive free cash flow generation.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.

Love the Grahams Geiger counter concept for tracking market valuations! Using net-nets as a proxy for overall market cheapness is brillant, even if todays net-nets aren't the same quality as the OG ones. The visual chart really puts things in perpective. Also interesting to see the Hooker Furnishings update - the Margaritaville licensing play sounds like a solid way to juice margins without huge capex, and the cost cutting should flow straight to the bottom line once demand stabilzes.