The North American Deep Value Week – 2026/02

Earnings & a Securitization

Companies mentioned:

Hurco Companies – Q4 and FY2025 Results

Natural Alternatives International – CEO Stock Donation Filing

ACRES Commercial Realty – Asset-Backed Securitization Due Diligence Filing

Kronos Worldwide – Q3 2025 Earnings Report

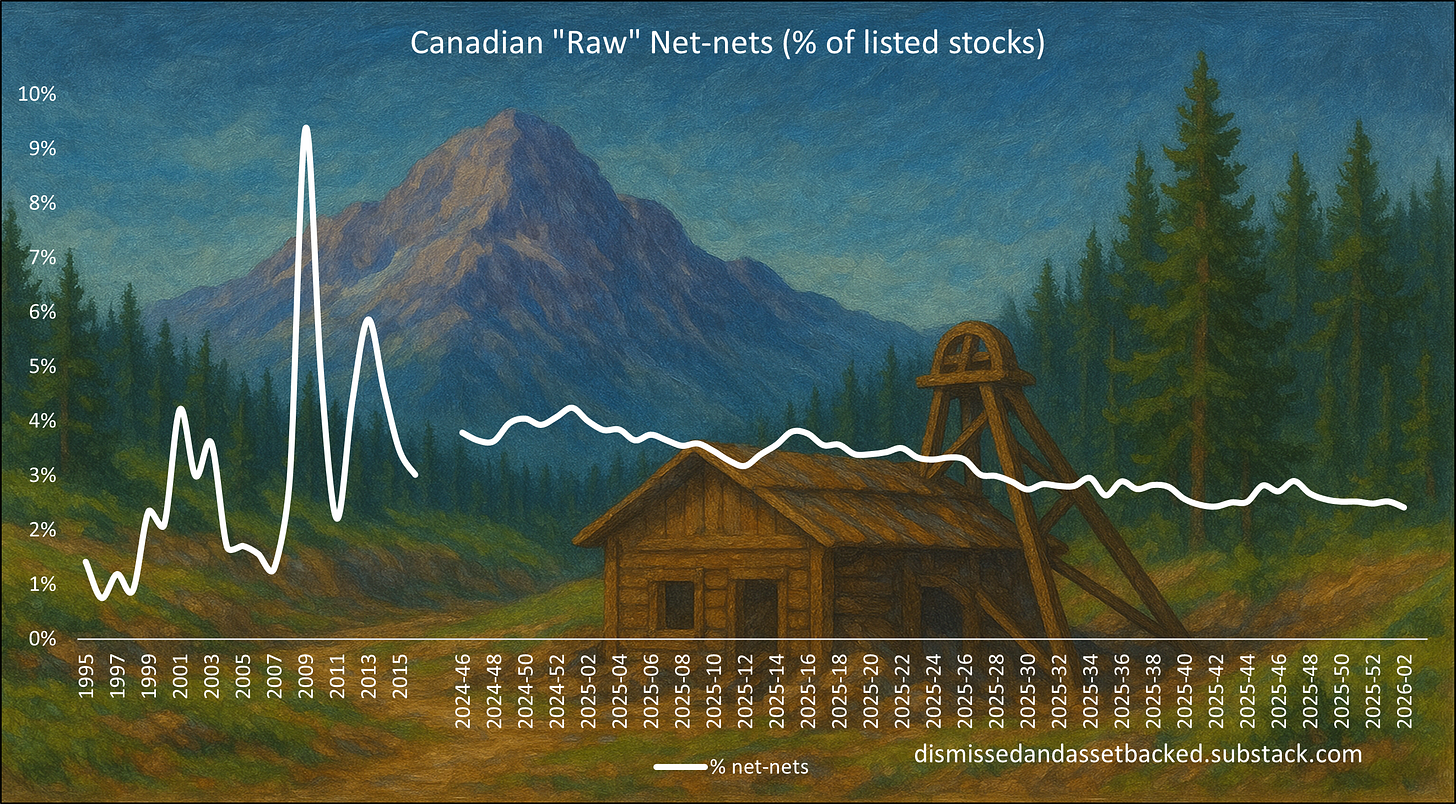

“Graham’s Geiger counter”

Benjamin Graham suggested that one way to measure the valuation of the overall market was to assess the number of net-nets available. When many such opportunities exist, it indicates a cheap market overall, while their absence suggests that the market is expensive. Today’s net-nets, however, are not the same as Graham’s net-nets. Many are un-investable being Chinese RTO’s, loss-making biopharma’s etc. But we do think it is interesting to follow this number over time, and what percentage of total listed stocks qualify as a “naked” net-net without any type of quality adjustments to make them investable.

Hurco Companies – Q4 and FY2025 Results

2026-01-09 │ P/TB 0.56 │ URL

January 9, 2026 – Hurco Companies, Inc. reported a net loss of $3.0m, or $0.47 per diluted share, for the fourth quarter ended October 31, 2025, compared to a $1.4m loss in the same period last year. For the full fiscal year 2025, the company posted a net loss of $15.1m ($2.34 per share), slightly improving from a $16.6m loss in 2024. Sales and service fees for the quarter fell 15% year over year to $45.5m, while full-year sales declined 4% to $178.6m. Gross margin decreased to 17% in Q4 and 18% for the year, reflecting lower sales volumes, unfavorable mix shifts from high-margin 5-axis to 3-axis machines, and higher import tariffs. By region, annual sales decreased 5% in the Americas, 4% in Europe, and 1% in Asia Pacific, with European weakness driven by softer demand in Germany, France, and Italy. Orders fell 14% year over year to $171.3m, led by declines in Europe and Asia Pacific. SG&A expenses declined $3m year over year to $43.2m, helped by cost controls and lower trade show spending, while cash increased to $48.7m from $33.3m a year earlier.

CEO Greg Volovic noted that both the U.S. and Germany saw their strongest quarter of orders and sales in Q4, with second-half activity improving about 5% versus the first half. He highlighted ongoing cost discipline and leadership changes aimed at execution and customer focus. Looking ahead, Hurco expects to navigate fiscal 2026 with a solid balance sheet, strengthened management, and a product lineup positioned for long-term growth.

Natural Alternatives International – CEO Stock Donation Filing

2026-01-05 │ P/TB 0.42 │ URL

January 5, 2026 – Natural Alternatives International, Inc. (Nasdaq: NAII) filed a Form 4 reporting a transaction by CEO, Chairman, and Director Mark A. LeDoux. On December 23, 2025, LeDoux donated 10,000 shares of company common stock without consideration to a private foundation for which he serves as President but holds no financial interest. Following the transaction, he directly owns 150,221 shares and indirectly holds additional shares through various entities, including 481,905 shares via the LeDoux Family Limited Partnership, 69,416 shares via an IRA, and smaller custodial holdings for family members. The filing indicates no sale or purchase for personal gain, as the transaction was entirely charitable in nature.

ACRES Commercial Realty – Asset-Backed Securitization Due Diligence Filing

2026-01-08 │ P/TB 0.35 │ URL

January 8, 2026 – ACRES Commercial Realty Corp. (NYSE: ACR) filed a Form ABS-15G related to its upcoming securitization, ACRES Commercial Realty 2026-FL4 Issuer, LLC. The filing was made under Rule 15Ga-2 of the Securities Exchange Act and included an independent accountants’ agreed-upon procedures report prepared by PricewaterhouseCoopers LLP (PwC). PwC was engaged by ACRES, together with Atlas SP Partners, Apollo Global Securities, J.P. Morgan Securities, Morgan Stanley, and Raymond James, to verify the accuracy of certain data and calculations relating to 18 mortgage loans secured by 20 commercial properties forming the securitization collateral.

PwC confirmed that the specified attributes and recalculated data matched the underlying loan and property documentation within the agreed tolerance levels. The firm emphasized that it did not audit or opine on the fair value of the securities, underwriting standards, or property valuations, and its work was limited to predefined verification procedures. The report concluded that all compared and recalculated items were in agreement with ACRES’ source data, supporting the accuracy of inputs used for the transaction’s due diligence documentation.

Kronos Worldwide – Q3 2025 Earnings Report

2026-11-06 │ P/TB 0.76 │ URL

November 6, 2025 – Kronos Worldwide, Inc. (NYSE: KRO) reported a Q3 2025 net loss of $37.0m ($0.32/share) versus a profit of $71.8m ($0.62/share) a year earlier, as weaker TiO₂ prices, lower production volumes, and $27m in unabsorbed fixed costs weighed on results, compounded by a $19.3m non-cash deferred tax charge from German tax reform. Net sales fell 6% to $456.9m, and segment results swung to a $15.3m loss from a $43.4m profit. For the first nine months, Kronos posted a $28.1m loss on sales of $1.44bn, with EBITDA dropping to $74m (from $211m). The company cited subdued global demand, customer destocking, and trade uncertainty, partly offset by a $4.6m non-cash gain from an earn-out revaluation related to its 2024 acquisition of Louisiana Pigment Company.

The writer may own shares of the companies mentioned. This communication is for informational purposes only. AI helped us with this. Check important info.