Activist Involvement in Chicago Rivet & Machine Co

Galloway Capital Partners Ups the Ante

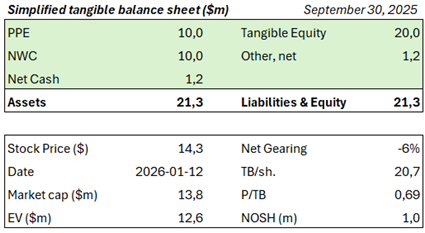

This week, as part of the “Major Shareholder portrait series”, we mentioned that Galloway Capital Disclosed (GCP) 6.45% Stake and Activist Intent in Chicago Rivet & Machine Co (CVR) - a deep value case for quite some time. CVR trades at $14.3, equivalent to market cap $14m, EV $13m and P/TB 0.69x.

CVR is a small (200 employees) industrial manufacturer, founded in 1927 and IPO’d in 1980, specializing in rivets, fasteners, and related tooling, as well as automated and semi-automated assembly machines that integrate fastening, feeding, and inspection functions into customer production lines primarily in automotive, aerospace, appliance, and general industrial applications.

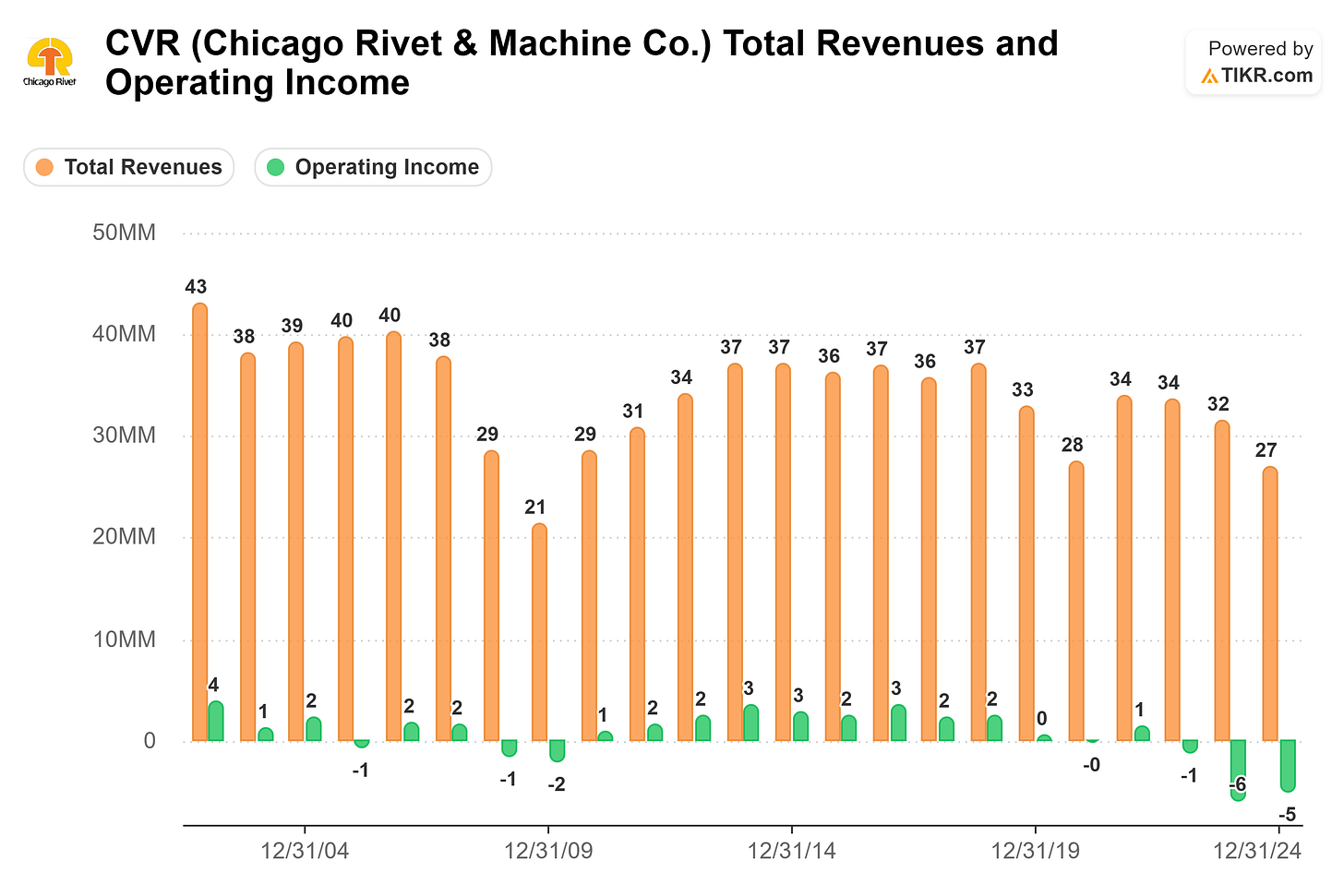

The company has experienced a long-term revenue decline, with sales decreasing from $43m in 2002 to $27m in 2024, pointing to underlying structural challenges rather than purely cyclical weakness. In 2023, the three largest customers were TI Group Automotive Systems (16%), Cooper-Standard Holdings (14%), and Martinrea (11%, TSE:MRE). In 2021, Parker-Hannifin accounted for 12% of revenues.

During 2022–2024, cost inflation, intense competition, and significant pricing pressure from automotive customers - accounting for roughly 2/3 of Fasteners revenue and about 80% in the U.S. - have weighed heavily on margins. Management has been focused on increasing prices, improving operational efficiency, and identifying new market opportunities, with the overarching objective of returning the business to profitability by gradually ensuring that all customer contracts are structured on a profitable basis. Chicago Rivet & Machine had going concern writings in the reports the past year.

Generational shift

Amid historical challenges, CVR underwent a transition in ownership and leadership following the passing of former Chairman and CEO Walter Morrissey in 2022, aged 79, after more than five decades of board service dating back to 1972. Walter Morrissey’s estate continues to hold an 8.7% equity stake and is closely linked to the controlling family ownership: he was the brother of the largest shareholder John Morrissey (age 90, 10.1% ownership) and related to current directors John L. Showel (age 60) and James W. Morrissey (age 54).

On the management side, long-tenured executive Michael Bourg - who served as President, COO, Treasurer, and board member since 2006 - retired during 2023. Subsequently, Gregory Risso (age 59) was appointed CEO in mid-2023, alongside the appointment of Joel Brown (age 57) as CFO.

Asset Backing

GCP also points to changes related to strategy and capital allocation, which are interesting. A quick desktop analysis indicates that EV ($13m) is basically fully backed by unlevered properties that have been held on the balance sheet for several decades (indicative total value of +$9-12m).

CVR owns the property in Michigan (116k sq.ft.) at comps valuation of $60-100/sq.ft be worth c. $6-8m. The property in Tyrone, Pennylvania (sitting on c. 12 acres) and measured to 105k sq.ft. on Google Earth could at comps valuation of $30-40/sq.ft be worth c. $3-4m. These are rough estimations.

As reference, in 3Q22, CVR sold its Illinois property (former HQ housing both segments, c. 55k square feet) for $5.4m, realizing a book gain of $4.7m and implying a transaction price of c. $1,060 per square meter.

Quick assumption: The core business should be capable of achieving at least a 2.5% margin even with rent philosophically being added back. This implies EPS of $0.80 and at 8x P/E the theoretical standalone value for the operations is $6.4 per share which is, if separated, on top of +-$9-12/share for the properties - a total of $15-18 per share (still below P/TB 1x).

Galloway Capital Partners (GVC)

GCP asserts that the shares are materially undervalued relative to the intrinsic earnings power and strategic positioning, pointing to potential sustainable earnings of $4-5 per share and structurally improving competitive dynamics for domestic manufacturers. This is far higher than assumed above.

Applying a multiple of 8x to this $4-5 per share earnings figure, implies a value of $32-40/share. The earnings imply double digit margins. Even if some growth is likely assumed in their calculation, these figures are on the surface somewhat aggressive.

GCP has indicated an intention to engage actively with the board and management and may pursue changes related to strategy, corporate governance, capital allocation, and investor relations; notably, it has already sent a letter to management advocating a more proactive approach to capital markets communication and the engagement of an experienced Wall Street advisor as a catalyst to unlock shareholder value.

In all instances - an activist intervention at CVR appears timely and potentially value-unlocking.

Disclaimer: This publication is not investment advice. The author was not compensated for this write-up and is not claiming to be an investment advisor. The opinions expressed are solely those of the author. The information herein is based on publicly available sources believed to be reliable but has not been independently verified. All opinions are subject to change without notice. The author holds shares in the mentioned company as part of a broadly diversified portfolio. Readers should conduct their own due diligence and consult a licensed financial advisor before making any investment decisions.